Sales Tax On Used Cars Virginia . Virginia collects a 4.00% state sales tax rate on the purchase of all vehicles with a minimum tax of 75 dollars. For example, if you purchase a new vehicle for. What is the sales tax on cars purchased in virginia? Vehicle sales and use tax is 3% of the sale price. Effective july 1, 2015, unless exempted under va. In addition to taxes, car purchases. So if your car costs you $25,000, you multiply that by 3% to get your tax amount. The sale tax on cars purchased in virginia is 4.15%. Virginia is required to collect a 4.15% sales and use tax (sut) at the time of titling whenever a vehicle is sold, and/or the ownership of the. The virginia department of motor vehicles states that there is a 4 percent sales tax rate for any vehicle that you purchase within.

from www.dochub.com

Virginia collects a 4.00% state sales tax rate on the purchase of all vehicles with a minimum tax of 75 dollars. What is the sales tax on cars purchased in virginia? In addition to taxes, car purchases. Vehicle sales and use tax is 3% of the sale price. Virginia is required to collect a 4.15% sales and use tax (sut) at the time of titling whenever a vehicle is sold, and/or the ownership of the. The virginia department of motor vehicles states that there is a 4 percent sales tax rate for any vehicle that you purchase within. The sale tax on cars purchased in virginia is 4.15%. Effective july 1, 2015, unless exempted under va. For example, if you purchase a new vehicle for. So if your car costs you $25,000, you multiply that by 3% to get your tax amount.

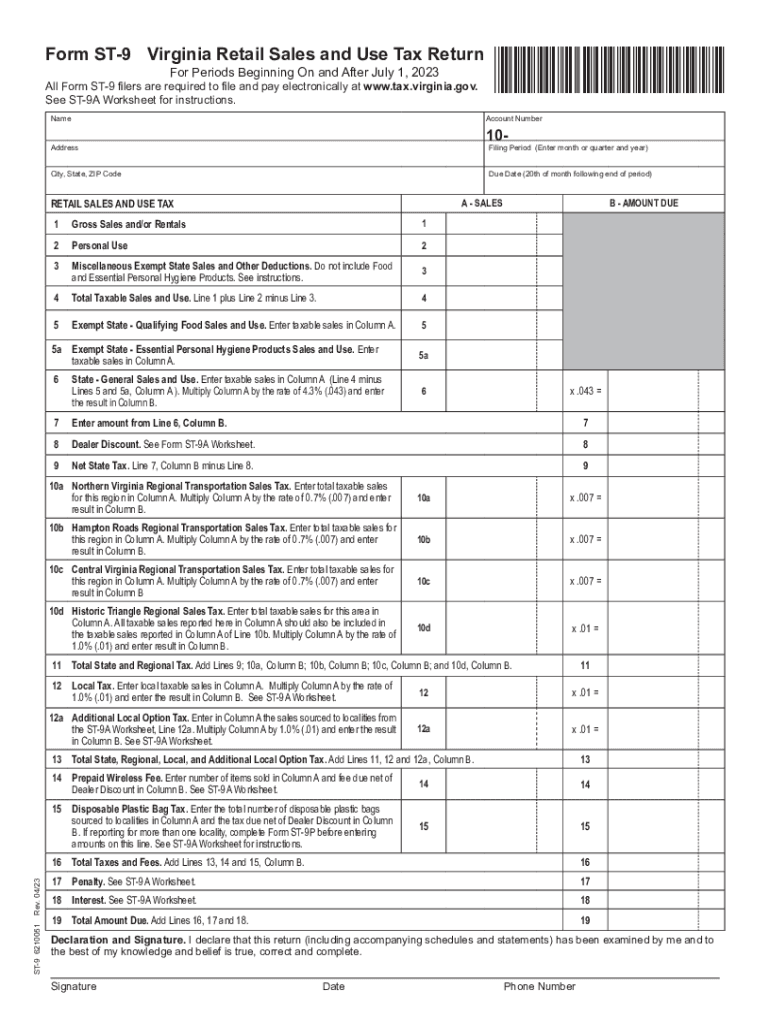

Virginia sales and use tax Fill out & sign online DocHub

Sales Tax On Used Cars Virginia So if your car costs you $25,000, you multiply that by 3% to get your tax amount. In addition to taxes, car purchases. Effective july 1, 2015, unless exempted under va. Vehicle sales and use tax is 3% of the sale price. The virginia department of motor vehicles states that there is a 4 percent sales tax rate for any vehicle that you purchase within. The sale tax on cars purchased in virginia is 4.15%. So if your car costs you $25,000, you multiply that by 3% to get your tax amount. Virginia collects a 4.00% state sales tax rate on the purchase of all vehicles with a minimum tax of 75 dollars. Virginia is required to collect a 4.15% sales and use tax (sut) at the time of titling whenever a vehicle is sold, and/or the ownership of the. For example, if you purchase a new vehicle for. What is the sales tax on cars purchased in virginia?

From privateauto.com

How Much are Used Car Sales Taxes in Virginia? Sales Tax On Used Cars Virginia So if your car costs you $25,000, you multiply that by 3% to get your tax amount. What is the sales tax on cars purchased in virginia? Vehicle sales and use tax is 3% of the sale price. The virginia department of motor vehicles states that there is a 4 percent sales tax rate for any vehicle that you purchase. Sales Tax On Used Cars Virginia.

From billofsale.net

Free Virginia DMV Bill of Sale Form PDF Word (.doc) Sales Tax On Used Cars Virginia What is the sales tax on cars purchased in virginia? Effective july 1, 2015, unless exempted under va. The virginia department of motor vehicles states that there is a 4 percent sales tax rate for any vehicle that you purchase within. So if your car costs you $25,000, you multiply that by 3% to get your tax amount. The sale. Sales Tax On Used Cars Virginia.

From www.dochub.com

Virginia sales and use tax Fill out & sign online DocHub Sales Tax On Used Cars Virginia Virginia collects a 4.00% state sales tax rate on the purchase of all vehicles with a minimum tax of 75 dollars. So if your car costs you $25,000, you multiply that by 3% to get your tax amount. Vehicle sales and use tax is 3% of the sale price. In addition to taxes, car purchases. What is the sales tax. Sales Tax On Used Cars Virginia.

From esign.com

Free Virginia Motor Vehicle Bill of Sale Form PDF Sales Tax On Used Cars Virginia The sale tax on cars purchased in virginia is 4.15%. Effective july 1, 2015, unless exempted under va. The virginia department of motor vehicles states that there is a 4 percent sales tax rate for any vehicle that you purchase within. Vehicle sales and use tax is 3% of the sale price. So if your car costs you $25,000, you. Sales Tax On Used Cars Virginia.

From cocosign.com

Virginia Vehicle Bill of Sale 1 Sales Tax On Used Cars Virginia So if your car costs you $25,000, you multiply that by 3% to get your tax amount. Effective july 1, 2015, unless exempted under va. The sale tax on cars purchased in virginia is 4.15%. For example, if you purchase a new vehicle for. What is the sales tax on cars purchased in virginia? Virginia collects a 4.00% state sales. Sales Tax On Used Cars Virginia.

From www.carsalerental.com

How To Figure Sales Tax On A Car Car Sale and Rentals Sales Tax On Used Cars Virginia The virginia department of motor vehicles states that there is a 4 percent sales tax rate for any vehicle that you purchase within. Virginia is required to collect a 4.15% sales and use tax (sut) at the time of titling whenever a vehicle is sold, and/or the ownership of the. Virginia collects a 4.00% state sales tax rate on the. Sales Tax On Used Cars Virginia.

From publiccarauctionscalifornia.com

Sales Tax on Used Cars in California Auto Auctions California Sales Tax On Used Cars Virginia The sale tax on cars purchased in virginia is 4.15%. The virginia department of motor vehicles states that there is a 4 percent sales tax rate for any vehicle that you purchase within. For example, if you purchase a new vehicle for. Vehicle sales and use tax is 3% of the sale price. Virginia collects a 4.00% state sales tax. Sales Tax On Used Cars Virginia.

From aditi.du.ac.in

Free California Motor Vehicle Bill Of Sale Form PDF, 04/13/2024 Sales Tax On Used Cars Virginia Virginia collects a 4.00% state sales tax rate on the purchase of all vehicles with a minimum tax of 75 dollars. The virginia department of motor vehicles states that there is a 4 percent sales tax rate for any vehicle that you purchase within. For example, if you purchase a new vehicle for. Effective july 1, 2015, unless exempted under. Sales Tax On Used Cars Virginia.

From dollirachel.pages.dev

When Is Tax Free Weekend 2024 In Virginia Perri Brandise Sales Tax On Used Cars Virginia So if your car costs you $25,000, you multiply that by 3% to get your tax amount. What is the sales tax on cars purchased in virginia? For example, if you purchase a new vehicle for. Effective july 1, 2015, unless exempted under va. The sale tax on cars purchased in virginia is 4.15%. The virginia department of motor vehicles. Sales Tax On Used Cars Virginia.

From pbn.com

Tax Foundation R.I. state sales tax second highest in country Sales Tax On Used Cars Virginia Effective july 1, 2015, unless exempted under va. Virginia is required to collect a 4.15% sales and use tax (sut) at the time of titling whenever a vehicle is sold, and/or the ownership of the. Virginia collects a 4.00% state sales tax rate on the purchase of all vehicles with a minimum tax of 75 dollars. The virginia department of. Sales Tax On Used Cars Virginia.

From miaqfidelity.pages.dev

Virginia State Tax Brackets 2024 Ardra Brittan Sales Tax On Used Cars Virginia In addition to taxes, car purchases. So if your car costs you $25,000, you multiply that by 3% to get your tax amount. Vehicle sales and use tax is 3% of the sale price. What is the sales tax on cars purchased in virginia? The virginia department of motor vehicles states that there is a 4 percent sales tax rate. Sales Tax On Used Cars Virginia.

From www.formsbank.com

Form St16 Sales And Use Tax Certificate Of Exemption Commonwealth Sales Tax On Used Cars Virginia Effective july 1, 2015, unless exempted under va. The sale tax on cars purchased in virginia is 4.15%. What is the sales tax on cars purchased in virginia? Virginia is required to collect a 4.15% sales and use tax (sut) at the time of titling whenever a vehicle is sold, and/or the ownership of the. So if your car costs. Sales Tax On Used Cars Virginia.

From www.parkers.co.uk

Car road tax your guide to Vehicle Excise Duty (VED) Parkers Sales Tax On Used Cars Virginia The sale tax on cars purchased in virginia is 4.15%. Virginia is required to collect a 4.15% sales and use tax (sut) at the time of titling whenever a vehicle is sold, and/or the ownership of the. For example, if you purchase a new vehicle for. Virginia collects a 4.00% state sales tax rate on the purchase of all vehicles. Sales Tax On Used Cars Virginia.

From www.pdffiller.com

Virginia Sales Tax License Fill Online, Printable, Fillable, Blank Sales Tax On Used Cars Virginia Virginia is required to collect a 4.15% sales and use tax (sut) at the time of titling whenever a vehicle is sold, and/or the ownership of the. Effective july 1, 2015, unless exempted under va. What is the sales tax on cars purchased in virginia? So if your car costs you $25,000, you multiply that by 3% to get your. Sales Tax On Used Cars Virginia.

From opendocs.com

Free Virginia Bill of Sale Forms (5) PDF WORD RTF Sales Tax On Used Cars Virginia For example, if you purchase a new vehicle for. Effective july 1, 2015, unless exempted under va. The virginia department of motor vehicles states that there is a 4 percent sales tax rate for any vehicle that you purchase within. Virginia is required to collect a 4.15% sales and use tax (sut) at the time of titling whenever a vehicle. Sales Tax On Used Cars Virginia.

From carchoiceonline.net

Used Cars Virginia Beach VA Used Cars & Trucks VA Car Choice Sales Tax On Used Cars Virginia Virginia collects a 4.00% state sales tax rate on the purchase of all vehicles with a minimum tax of 75 dollars. Virginia is required to collect a 4.15% sales and use tax (sut) at the time of titling whenever a vehicle is sold, and/or the ownership of the. Vehicle sales and use tax is 3% of the sale price. What. Sales Tax On Used Cars Virginia.

From allaboutfinancecareers.com

All about the Virginia Car Sales Tax Sales Tax On Used Cars Virginia Vehicle sales and use tax is 3% of the sale price. In addition to taxes, car purchases. For example, if you purchase a new vehicle for. So if your car costs you $25,000, you multiply that by 3% to get your tax amount. Virginia collects a 4.00% state sales tax rate on the purchase of all vehicles with a minimum. Sales Tax On Used Cars Virginia.

From www.signnow.com

Wv Farm Tax Exempt 20052024 Form Fill Out and Sign Printable PDF Sales Tax On Used Cars Virginia What is the sales tax on cars purchased in virginia? For example, if you purchase a new vehicle for. Virginia collects a 4.00% state sales tax rate on the purchase of all vehicles with a minimum tax of 75 dollars. In addition to taxes, car purchases. Vehicle sales and use tax is 3% of the sale price. Effective july 1,. Sales Tax On Used Cars Virginia.